Hotels good fortune continues but as uncertainty weighs in, is this as good as it gets? UK hotels have enjoyed record trading, underpinned by the boom in overseas leisure travel.

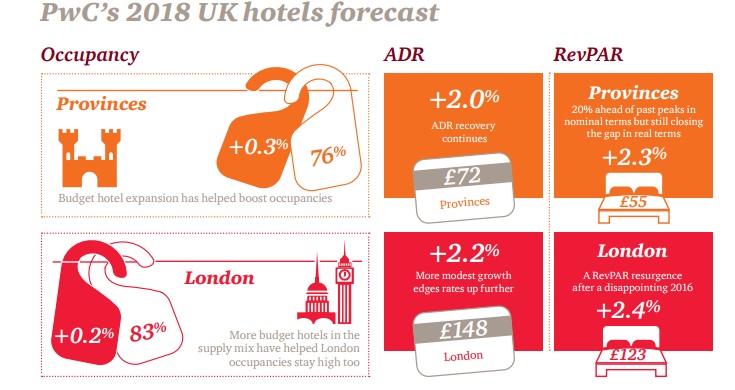

PwC forecast a slower pace of growth in 2018 as the stimulus of the weak pound starts to weaken, and new supply kicks in. Add into the mix, global political volatility, an expected deceleration in UK economic growth and continued Brexit policy uncertainty, and we look to a more cautious, but still reasonably strong growth forecast in 2018.

London

London enjoyed occupancy growth of 2.6% and ADR gains of 6.3% driving RevPAR growth of 9%, compared to the same period last year. The surge in overseas tourism has been boosted by North American visitors, with sterling at the lowest it’s been against the dollar for 30 years. The results are still remarkable against the backdrop of an uncertain corporate and consumer outlook, recent terrorist attacks, and high levels of new supply openings. The tourism boom means that for 2017 as a whole, our revised forecast is now much stronger than we anticipated in March this year. We now forecast year-on-year London occupancy growth of 2.3% and a robust RevPAR gain of almost 6% this year in 2017.

Regional outlook

Regional outlook

H1 2017 saw hoteliers in Edinburgh, Cardiff and Belfast, like London, see a boost from the exchange rate attracting international holiday travellers and this has pushed their RevPAR performance into double digit growth. Edinburgh and Belfast have seen ADR gains alone of 14.8% and 13% whereas Cardiff’s additional hosting of the Champions League Final in June, helped lift occupancy and rates and pushed RevPAR to almost 11% RevPAR growth in the first half of the year. Plymouth, Sheffield, Glasgow, York and Liverpool have also seen robust growth.

Hull has enjoyed City of Culture status in 2017 and hotels are reported to have seen a 13% occupancy lift in Q1 2017. In the first few weeks following the Manchester Arena bombing attack on 22 May, hotel general managers in the city’s hotel association reported a softening demand for hotel rooms. Recent coverage suggests that while there was a lot of uncertainty, that feeling is starting to change now, with tourists, visitors and families returning to stay in the city’s hotels.

What to expect for 2018?

What to expect for 2018?

We forecast both overseas inbound and domestic investment into the hotel sector to continue into 2018, with the ongoing growth in investment appetite into the sector by the more institutional and mainstream real estate investors. It will be interesting to see the outcome of the current portfolio deals to see whether vendor price expectations are achieved, and the impact this may have on the strategy for any future portfolio deals running into 2018. It also remains to be seen the longer term effect of the drive by China to limit foreign investment, once any of the larger portfolio deals do return. Considering these factors, combined with forecast slower RevPAR growth across the UK, overall we expect 2018 deal volumes to reach levels c.10% lower than the current year, at around £4.8bn.

Download the full report here. . .