Commercial property specialists Savoy Stewart predicts the rise in UK hotel development between now and 2021…

As the industry gears up to this year’s Brit List, which will recognise and celebrate Britain’s best interior designs, hoteliers and architects, a report by commercial property specialist Savoy Stewart suggests that the UK will remain an international hotel design hub as figures suggest major growth in tier two cities in particular.

Last year, the proportion of new build hotels in the UK rose by 37 per cent, which reflects 2.4 per cent growth in the UK hotel supply.

In 2018, new build hotel growth in Britain has continued its upward trajectory. Per Knight Frank’s report UK Hotel Development Opportunities 2018, projected forecasts proclaim the UK hotel market will grow by 3.3 per cent this year, eclipsing 2017 and equating to over 21,000 new hotel rooms. In fact, more than 5,200 new hotel rooms opened during the first six months of 2018 and a further 15,000 hotel rooms have been in the works since then.

“Belfast has experienced the largest increase in new hotel supply.”

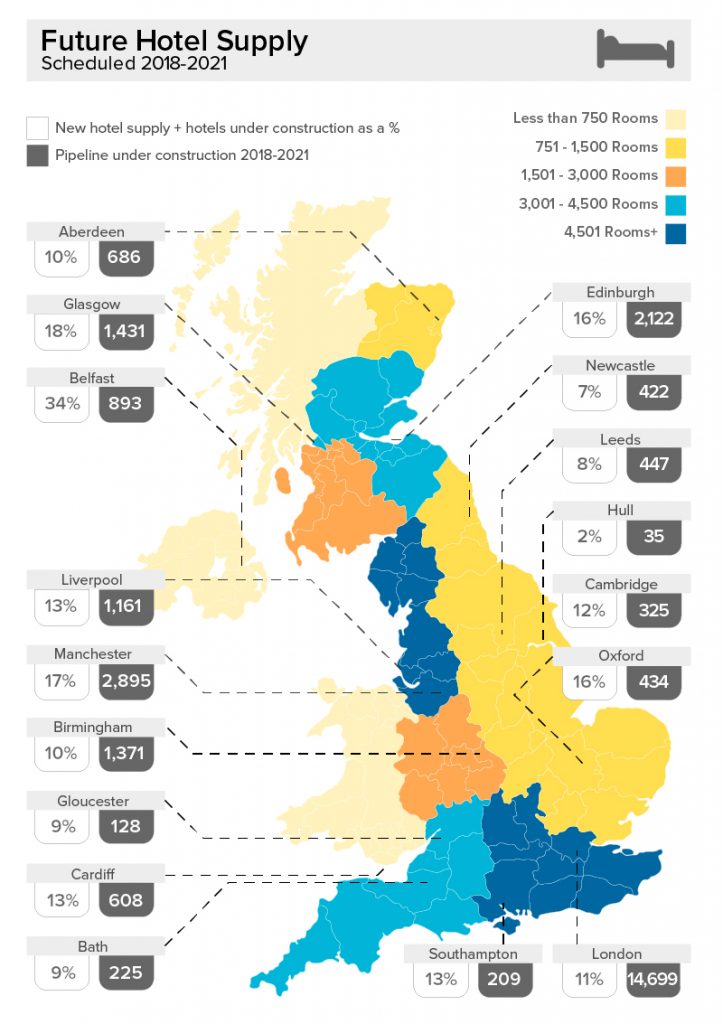

Such extensive growth in new build hotels is, after all, fuelling the pace of hotel development across the UK. To achieve this, Savoy Stewart analysed Knight Frank’s Hotel Development Opportunities report in depth, to pull the facts together and present a picture of what the future hotel supply will look like in the next three years (2018 to 2021.)

Belfast has experienced the largest increase in new hotel supply and hotels under construction (as a % of supply) in 2018 – at 34 per cent. Meanwhile, Glasgow (18 per cent) and Manchester (17 per cent) have experienced healthy growth in new hotel supply and hotels under construction in 2018 too.

“London aside, Manchester holds the next highest total of new rooms in the pipeline.”

Comparatively, Hull has experienced the smallest increase in new hotel supply and hotels under construction (as a % of supply) in 2018 – at 2 per cent. Meanwhile, Newcastle (7 per cent) and Leeds (8 per cent) have experienced similar, slow levels of growth in new hotel supply and hotels under construction in 2018.

Future Hotel Supply 2018-2021

Future Hotel Supply 2018-2021

In terms of rooms in the pipeline/under construction (2018-2021), it may come as no surprise that London will see the highest number of new rooms developing in the future – at 14,699. The capital accounts for 40 per cent of the development pipeline of hotels under construction in the UK.

London aside, Manchester holds the next highest total of new rooms in the pipeline, with an impressive 2,895 expected, followed closely by Edinburgh with 2,122. With the successful regeneration, transformation and reshaping of several UK cities, largely through joint public/private initiatives and institutional investment; targeted hotel development in key UK cities has been the driving force behind such growth. Manchester is a prime example.

Tier two cities such as Glasgow (1,431), Birmingham (1,371) and Liverpool (1,161) will follow suit, with considerable numbers of new rooms in the pipeline over the next few years.

At the other end of the scale, with far fewer new rooms forecast 2018-2021 is Bath (225), Southampton (209) and Gloucester with 128. East Yorkshire’s port city, Hull, lands last in the list with just 35 new rooms in the pipeline.

With the aim to celebrate the best British designers, architects and hoteliers, this year’s Brit List will take place on November 22 at BEAT London. Please click here in order to purchase your ticket.

Main image credit: Titanic Hotel, Belfast