Chester has reached the top of Colliers International’s latest UK Hotels Market Index, an analysis of 34 locations across the UK, ranked to determine the ‘hot spots’ for hotel development and acquisition across the country. The city’s high position is mainly due to good occupancy levels, an upward revenue per available room (RevPAR) trend and a low active pipeline.

The report uses nine Key Performance Indicators (KPIs) to score each of the 34 locations a figure from one to five (one being the lowest and five being the highest). The determining indices include land site prices; build costs; market appetite; valuation exit yields; room occupancy; average daily rate; room occupancy rates; four year RevPAR Trend; active pipeline as a percentage of current supply and construction costs. The ratings are then consolidated into a single figure and ranked to show which markets are hot and which are not in terms of a desirable location for investors to acquire an existing hotel or develop a new one.

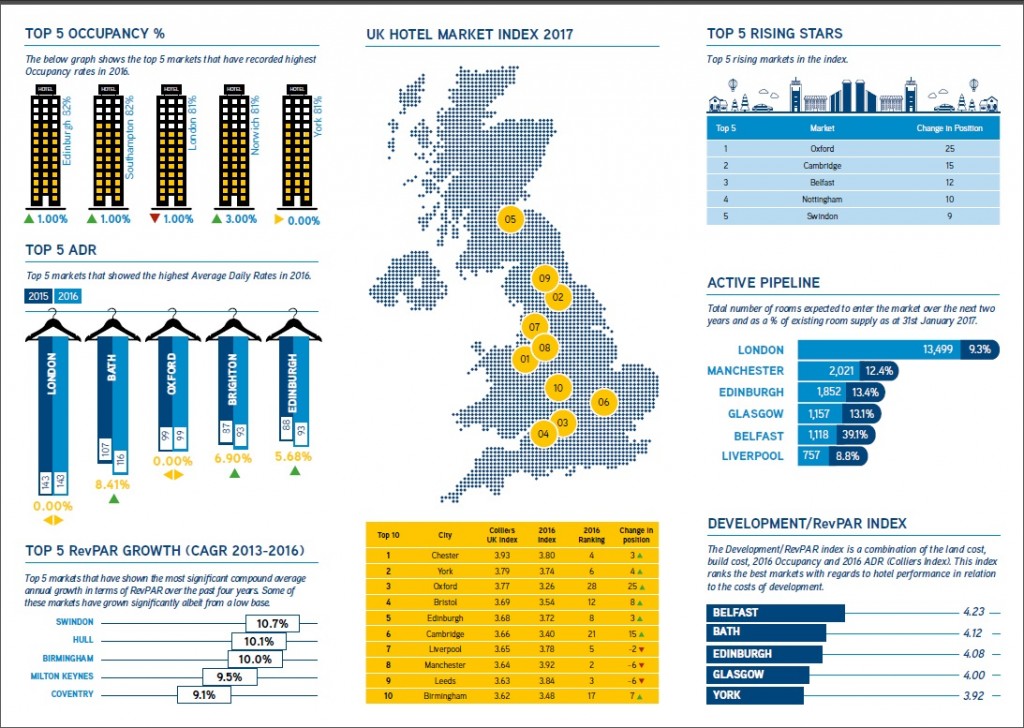

Marc Finney, Head of Hotels & Resorts Consulting, Colliers International said: “The data in our second report reveals the ever-changing nature of the UK hotels market. Cities such as Oxford and Cambridge have really upped their game in the last year to make it into the top five, despite failing to score in the top 15 last year. Of course, this is a general market index and site specific factors will lead to significant variances but the data demonstrates that London is not the only city that investors should be watching and offers a credible indication to influence their decision making process.”

Hot Spots

• York ranks second in the list, moving four places up from last year, owing to good hotel performance indicators and a positive RevPAR trend.

• Oxford positioned third in the index, improving its ranking by 25 spots from last year, due to an increase in buyer demand interest, a low active pipeline in the city and good hotel market performance.

• Other rising stars in terms of markets to watch out for include Cambridge, which has moved up 15 spots from 2016; Belfast, which has improved by 12 spaces; Nottingham is 10 rankings higher and Swindon is 9 slots ahead of the 2016 index.

• London continues to be the largest market and in terms of RevPAR, is still the top performing market. It also has the most active pipeline in terms of rooms expected to come to the market over the next two years (13,499). However, given that the index punishes high land costs, high construction costs, sluggish hotel growth in recent years and a strong active pipeline, some markets rank lower than expected and as such, the UK’s capital city has fallen out of the top 10, having experienced a drop in RevPAR (-1.2 per cent), a large development pipeline as well as high land costs.

• Edinburgh and Southampton have the highest occupancy rates at 82 per cent.

• The top five markets that have shown the most significant compound average (mean) annual growth in terms of RevPAR over the past four years include Swindon, Hull, Birmingham, Milton Keynes and Coventry.

Marc Finney continues: “London is by far the largest market with almost as much supply as all of the other markets combined and has recently been a star in terms of revenue per available room. However, it is now only ranking in position 12 in our index due to slow growth in 2016, high construction costs and high land values.”