Statistics from Lodging Econometrics show impressive double-digit growth year-over-year in hotel development in Europe…

Lodging Econometrics’ (LE) analysts report another year of accelerating growth for Europe’s hotel construction pipeline which is at the highest level since LE began recording in 2007. The total pipeline stands at 1,388 projects/219,251 rooms for the second quarter of 2018. It is an impressive 18 per cent increase year-over-year (YOY).

Europe had significant growth in new hotel openings in the first half of 2018 with 198 hotels/26,164 rooms, up 38 per cent over the first half of 2017

There are 693 projects/112,580 rooms currently under construction, 403 projects/62,538 rooms planning to start construction in the next 12 months, and 292 projects/44,133 rooms in the early planning stage. Projects currently under construction and those in early planning are also at their highest since 2007.

Europe had significant growth in new hotel openings in the first half of 2018 with 198 hotels/26,164 rooms, up 38 per cent over the first half of 2017 when 144 hotels/21,288 rooms opened. The LE forecast for new hotel openings shows continued growth for the next several years with a total of 367 new hotels/49,295 rooms opening by the end of 2018, followed by 383 hotels/53,030 rooms expected in 2019, and 392 hotels/60,740 rooms in 2020. Metrics for new hotel openings are also at their highest since 2007.

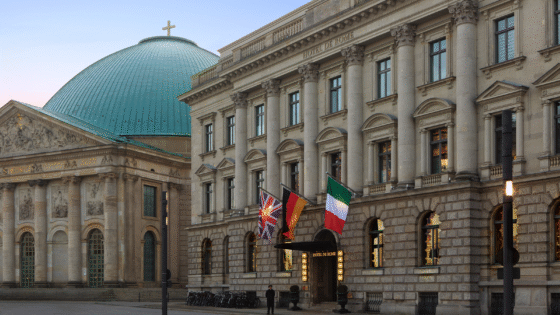

The top countries in Europe’s construction pipeline are Germany with 247 projects/47,155 rooms, the United Kingdom with 247 projects/36,487 rooms, France with 130 projects/15,198 rooms, Portugal with 83 projects/8,531 rooms, and Poland with 80 projects/12,221 rooms. All of these countries reached their highest levels since 2007 in either the first or second quarter of 2018.

The top hotel companies in Europe’s construction pipeline are AccorHotels with 220 projects/28,281 rooms, Marriott International with 178 projects/29,740 rooms, Hilton Worldwide with 166 projects/26,114 rooms, and InterContinental Hotels Group (IHG) with 138 projects/23,044 rooms. These four companies comprise 51 per cent of the total hotel construction pipeline in Europe.

The largest brands for each of these top companies are AccorHotel’s Ibis brands with 125 projects/15,391 rooms, Mercure Hotel with 24 projects/2,371 rooms, and Adagio City Aparthotel with 21 projects/2,844 rooms; Marriott International’s Moxy with 54 projects/9,615 rooms, Courtyard by Marriott with 32 projects/5,797 rooms, and the Autograph Collection with 14 projects/1,926 rooms. In addition, Hilton Worldwide has Hampton Inn with 69 projects/ 10,438 rooms, Hilton Garden Inn with 43 projects/6,644 rooms, DoubleTree by Hilton with 21 projects/3,042 rooms; and IHG’s Holiday Inn Express with 65 projects/9,873 rooms, Holiday Inn with 33 projects/7,116 rooms, and Hotel Indigo with 15 projects/1,897 rooms.