Why use eChecks for Canadian online gaming?

In recent years, things have changed dramatically. We as a society spend significantly less time looking for physical entertainment of the gaming variety for a variety of reasons. We are more likely to play games on a mobile device, even casino-style games like slot machines, blackjack, and roulette, due to time constraints or a general preference for digital activities.

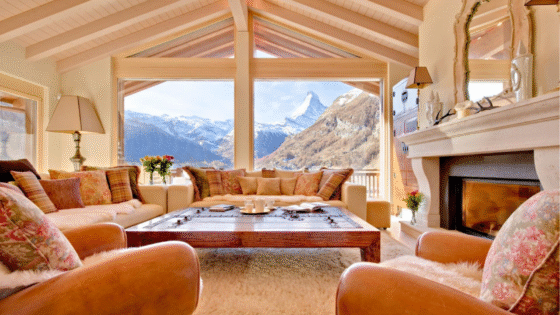

It’s enjoyable, secure, and practical to play your preferred Vegas-style games at an online casino from the comfort of your home. Finding a secure and convenient method to top off your real money casino account without facing additional costs, hiccups, or inconveniences is essential. In iGaming, credit cards are frequently refused. Identity fraudsters frequently target debit cards.

Paper checks take a very long time to reach your bank and clear, despite the fact that they are relatively secure. Despite the “convenience fees” they charge for some types of transactions, e-wallets are fantastic. The eCheck is one of the best substitutes for Canadian gamers. It blends traditional paper transactions with the efficiency and practicality of electronic payment systems, and it is free.

How are eChecks Operated?

An eCheck is essentially a paper check that is electronically written and signed. There is no need to sign it, and there is no paper or pen. It is processed as an EFT, or electronic fund transfer, in which the bank and casino instantly exchange payment information.

When a player makes a deposit using an eCheck or EFT, the following takes place:

- A digital transmission is sent by the casino to the player’s bank, asking if the amount to be deposited is in their account.

- With a digital transmission of its own, the bank responds immediately with either a “Yes” or “No” response.

The usual “3 to 5 business days” will pass before the casino actually receives that money, just like with a paper check. However, since they are aware that the funds are accessible and that the bank is already starting to process the payment, the casino is more than pleased to give the player quick access to the money. This is how stunning the EFT banking systems in Canada are. If you want to learn more about this question, then go to LeafletCasino and read our latest review of the best eCheck online casinos in Canada.

Deposit money at an eCheck casino

You must register your bank information with the online casino before utilizing an eCheck there. In order to do this, you must be able to supply fundamental information, such the name of the financial institution in charge of the checking account, the account number, and the routing number of the bank. Remember that the personal data associated with your bank account must match the data you submitted to open your online casino account in order to process eCheck payments.

You can locate the account number, bank name, and routing number needed to submit an eCheck on your own paper checks. Unless you don’t have any paper checks, you don’t need to contact the company that issued the check for more information. If that is the case, all you need to know is to give your financial institution a quick call.

A word of caution: eChecks can bounce just like paper checks. Mind you, it’s not often. If there aren’t enough funds, your bank should stop the payment. When the casino asks for those funds, your bank should immediately place a hold on them if they are available. However, it is still possible to experience this, and if it does, you will be assessed an NFS (insufficient funds) overdraft fee, which, depending on your bank, can cost anywhere from $25 to $40. The only potential drawback of depositing with eCheck casinos is this, and it is simple to avoid it. Don’t use the money from an eCheck payment before it leaves your bank.

Different kinds of eChecks

There are many different kinds of eChecks, and not all of them are created equal. EFT and ACH are the two main types.

Electronic fund transfers, or EFTs, are when a bank and a retailer instantly communicate a digital message to ensure that the money is in the customer’s bank account. All Canadian-based banks employ this method when processing an eCheck.

Even though the process is nearly same, ACH payments are occasionally delayed. Automated Clearing House is what ACH stands for. Each bank sets its own processing time for ACH transactions. Like an electronic funds transfer (EFT), some will process them right away, but most banks will let them build up until a specific time of day. Anytime they choose—at the conclusion of a business day, at midnight, or at six in the morning the next day. All ACH payments are processed at that point.