A number of people have asked themselves how the recent tragedies in the UK might have affected the market’s hotels. While there is still not a long enough range of data to draw any definitive conclusions, STR thought it important to take this opportunity to look into it in some detail.

According to STR figures, the UK hotel market has experienced a strong start to 2017, with year-over-year RevPAR growth of 6.5% as of April year-to-date data. As evidenced by March data from VisitBritain, the country has seen an influx of arrivals, thanks in large part to the devaluation of the pound following the Brexit vote last June.

Now, questions have emerged around the sustainability of this performance, following the recent terrorist attacks in the country. Earlier reports have suggested an impact on visitor numbers to attractions in the UK. It is reasonable to expect a negative impact on hotel performance given the unthinkable tragedies the country has experienced over the past several months. The UK maintained performance growth without much disruption following the March Westminster and May Manchester attacks, but it is still too early to fully gauge the effects of the 3 June attack at London Bridge or the 18 June attack at Finsbury Park, though some insights are available for the former.

Now, questions have emerged around the sustainability of this performance, following the recent terrorist attacks in the country. Earlier reports have suggested an impact on visitor numbers to attractions in the UK. It is reasonable to expect a negative impact on hotel performance given the unthinkable tragedies the country has experienced over the past several months. The UK maintained performance growth without much disruption following the March Westminster and May Manchester attacks, but it is still too early to fully gauge the effects of the 3 June attack at London Bridge or the 18 June attack at Finsbury Park, though some insights are available for the former.

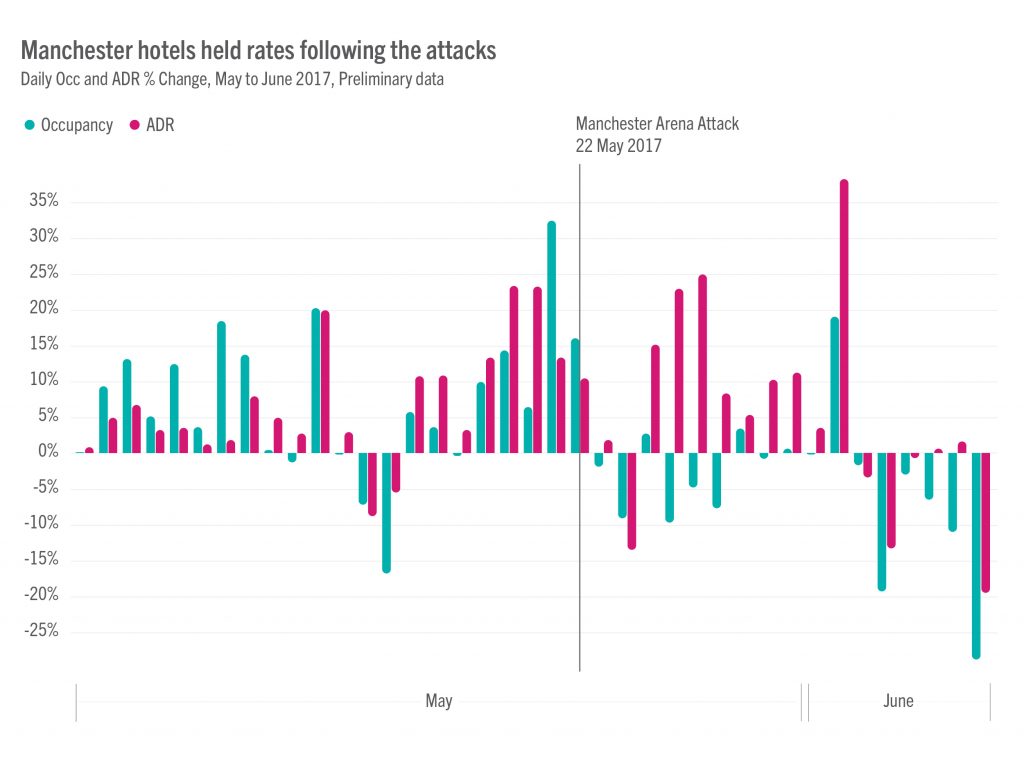

An initial analysis from the Manchester attack shows that the city’s hotels experienced a minor year-over-year dip in occupancy (-1.9%) the day after the attack, before returning to growth the following day, 25 May (+2.7% to 79.8%). Following that date, performance has fluctuated due to other factors, including the hosting of the U20 Rugby Championship.

An initial analysis from the Manchester attack shows that the city’s hotels experienced a minor year-over-year dip in occupancy (-1.9%) the day after the attack, before returning to growth the following day, 25 May (+2.7% to 79.8%). Following that date, performance has fluctuated due to other factors, including the hosting of the U20 Rugby Championship.

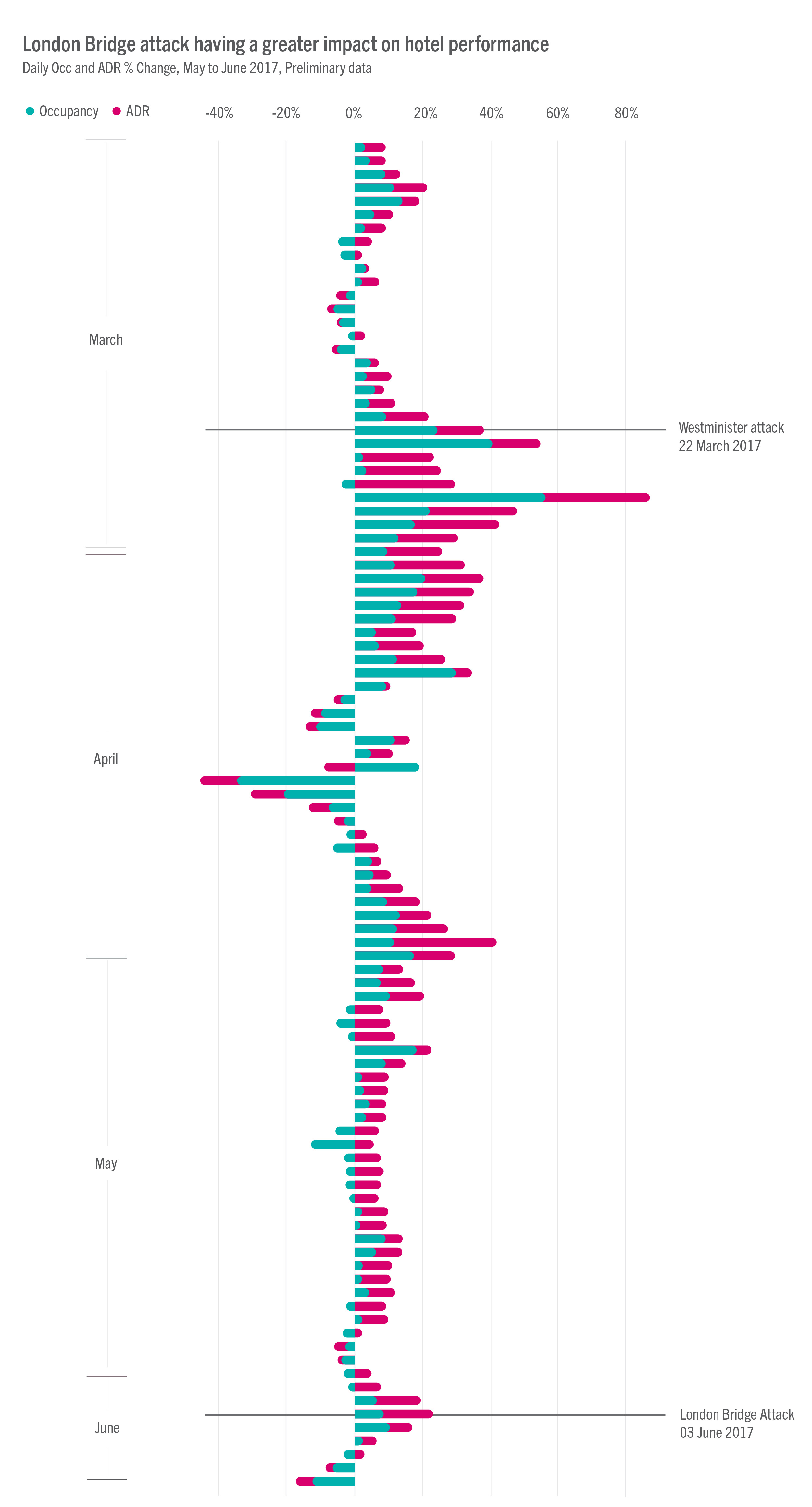

Daily figures suggest that the London Bridge attack may be impacting the UK capital’s performance more significantly than previous attacks this year have. Preliminary data shows that performance started to decline on Wednesday 7 June, with both occupancy and ADR declining in a year-over-year comparison. The sharpest declines were seen on Thursday 8 June, with an 11% drop in occupancy and a 4% drop in ADR. However, these decreases may be in part a reflection of the comparison with the time of the EULAR medical congress last year.

Daily figures suggest that the London Bridge attack may be impacting the UK capital’s performance more significantly than previous attacks this year have. Preliminary data shows that performance started to decline on Wednesday 7 June, with both occupancy and ADR declining in a year-over-year comparison. The sharpest declines were seen on Thursday 8 June, with an 11% drop in occupancy and a 4% drop in ADR. However, these decreases may be in part a reflection of the comparison with the time of the EULAR medical congress last year.

In closing, STR again stresses that it is essential to analyse a longer time period and more complete data set before drawing definitive conclusions. Specifically in London, hotels have shown resilience during difficult times in the past.

STR provides clients from multiple market sectors with premium, global data benchmarking, analytics and marketplace insights. Founded in 1985, STR maintains a presence in 16 countries with a corporate North American headquarters